Promotional products in Houston can be an amazing way to build brand awareness, drive engagement, and reward loyal customers. But if you’re handing out branded merchandise in Texas—especially for free—it’s essential to know the tax rules that apply.

So, are giveaways in Houston taxable?

Short answer: Sometimes, yes. And failing to understand when taxes apply could lead to unexpected costs or even penalties for your business.

Let’s break down exactly what you need to know to stay compliant and confident while planning your next giveaway.

Understanding Texas Sales Tax on Promo Items

Texas considers most tangible personal property taxable. That includes items like mugs, t-shirts, pens, and USB drives—aka all the popular promo items. Whether you sell them or give them away, the use of those products in Texas might be subject to sales or use tax.

Here’s a quick guide:

- Purchased for resale? No tax due at purchase, but tax might apply later depending on use.

- Given away for free? You owe use tax on the cost of the item (not the retail value).

- Bundled with a sale? You may owe tax on the entire bundle, unless it’s clearly separated.

What Is “Use Tax” in Texas?

Use tax is a lesser-known cousin of sales tax. If your business buys items tax-free—let’s say you purchase 1,000 custom branded water bottles from a supplier—and you don’t sell them but give them away at a Houston trade show, you owe use tax on the cost of those items.

That means if each water bottle cost $1 and you gave away 1,000, you’d owe tax on $1,000.

Important note: Even if your vendor didn’t charge sales tax, Texas still expects you to pay use tax. It’s your responsibility to report and remit it.

When Do You Need a Texas Sales Tax Permit?

If you’re a Houston business regularly distributing promotional items, it’s smart (and often necessary) to get a Texas sales tax permit. Even if your giveaways aren’t part of retail sales, you might need this permit to report and pay use tax correctly.

Having the permit also allows you to issue resale certificates when you buy goods for resale. But again—if you don’t end up reselling the item and instead give it away, you have to pay tax on your cost.

A Houston Boutique’s Surprise Tax Bill

A small women’s clothing boutique in the Heights wanted to celebrate its 5-year anniversary with a bang. They ordered 500 custom tote bags with their logo to give away at an in-store event. They bought the totes online and didn’t pay sales tax at checkout, assuming it wasn’t necessary.

Two months later, their accountant brought up use tax. Turns out, they owed tax on the $1,250 spent on the totes. Luckily, they caught it early and avoided fines—but it was an unexpected cost. Since then, they’ve updated their internal checklist for giveaways to always include a compliance review.

Are All Promo Items Taxed Equally?

Generally, yes, but how they’re distributed matters. Giving away branded hats at an Astros tailgate is different (tax-wise) than including a free pen with every online order.

Here are a few scenarios:

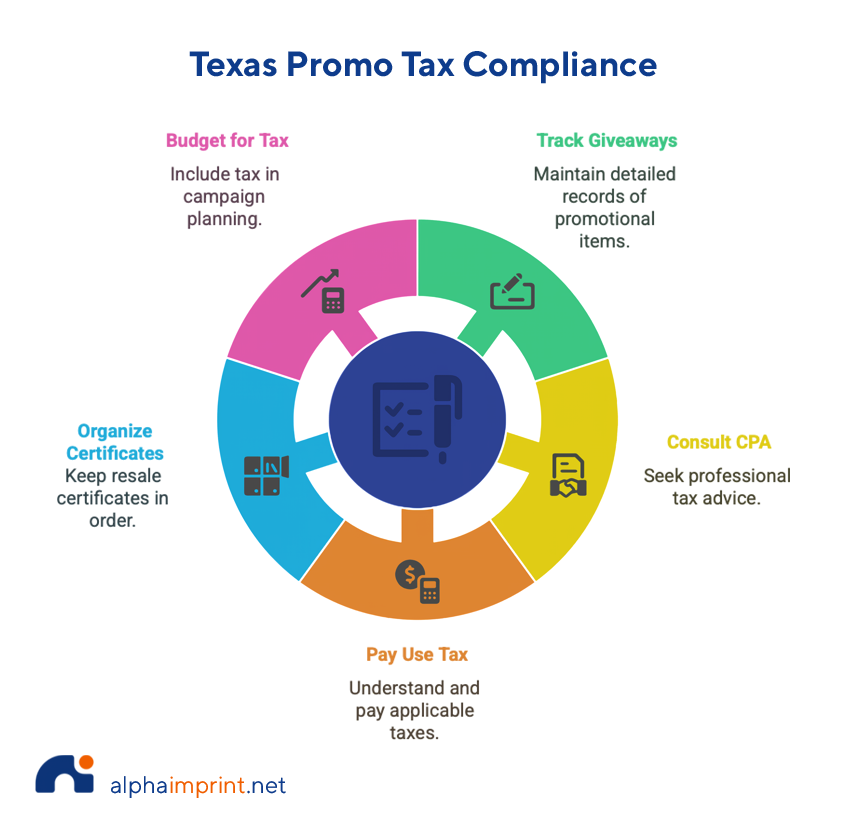

Tips to Stay Compliant with Texas Promo Tax Laws

- Track all giveaways – Keep clear records of quantity, cost, and purpose.

- Consult your CPA – Tax rules can change, and professional guidance is worth it.

- Pay use tax when required – Don’t assume “free” means tax-free.

- Keep resale certificates organized – Only use them for resale purchases.

- Build tax into your budget – Include estimated use tax when planning Houston promotional campaigns.

FAQs

Q: What is the use tax rate in Texas?

A: It’s the same as the sales tax—usually 6.25% statewide, plus local rates (up to 8.25% in Houston).

Q: Can nonprofits avoid paying tax on promo giveaways?

A: Some nonprofits may qualify for exemptions, but they must apply and show documentation. It doesn’t happen automatically.

Q: How do I report use tax in Texas?

A: If you have a Texas sales tax permit, you can report it on your regular sales tax return under the “use tax” section.

Q: What items are easiest to manage from a tax perspective?

A: Simple, low-cost items like custom pens with your logo, stickers, and notepads are easier to track and calculate than higher-value electronics or bundles.

Partnering with a Local Expert Helps

At Alpha Imprint, we work with Houston businesses every day who want to offer promotional products without unexpected surprises. From apparel to drinkware, we not only help you choose the right item—we can also advise on the most efficient way to manage taxes and avoid hidden costs.

Because let’s be real—free stuff isn’t really free when tax comes knocking.

Final Thoughts

When you’re building a strong brand presence in Houston through promotional products, the last thing you want is to get caught off guard by tax issues. Understanding and applying the right Texas tax rules—especially for giveaways—is part of being a responsible, smart marketer.

With a little planning and a local promotional products expert, you can keep your promo campaigns compliant, cost-effective, and successful.